Avoiding Construction Project Delays Due to Subcontractor Tax Debt

In the construction industry, subcontractor tax debt can lead to significant project delays, legal complications, and financial risks. Understanding how to verify subcontractor tax status and proactively manage potential tax issues is crucial for maintaining project timelines and compliance. This article delves into practical steps for preventing delays caused by subcontractor tax debt.

Table of Contents

How to Check Subcontractor Tax Status

Before engaging a subcontractor, it’s essential to verify their tax compliance. In Estonia, the Tax and Customs Board provides an online portal where businesses can check the tax status of subcontractors. This is particularly important as Estonia has stringent tax regulations, and engaging a subcontractor with unresolved tax issues can lead to penalties and project delays.

Similarly, in Poland, the Central Register and Information on Economic Activity (CEIDG) allows businesses to verify the tax status of subcontractors. Ensuring that subcontractors are tax-compliant can prevent potential legal issues and project disruptions.

In Ireland, the Revenue Commissioners offer a service to verify subcontractors’ tax compliance. It’s advisable to check the subcontractor’s status before commencing any work to avoid potential legal issues.

Before engaging a subcontractor, it’s essential to verify their tax compliance. Tools like Remato can help you track subcontractor credentials and ensure compliance, giving your team confidence on-site (How to Win More Construction Bids as a Subcontractor Without Dropping Your Price)

Project Scheduling Failures Due to Subcontractor Tax Debt

Engaging a subcontractor with outstanding tax liabilities can disrupt project schedules. For instance, in Estonia, companies with unresolved tax debts may face legal actions, leading to their inability to work on construction sites. This can cause delays as contractors may need to find alternative subcontractors at short notice.

Similarly, in Ireland, subcontractors with tax issues may be subject to Revenue audits, potentially halting their work until compliance is achieved. Such disruptions not only delay the project but can also increase costs and strain relationships with clients.

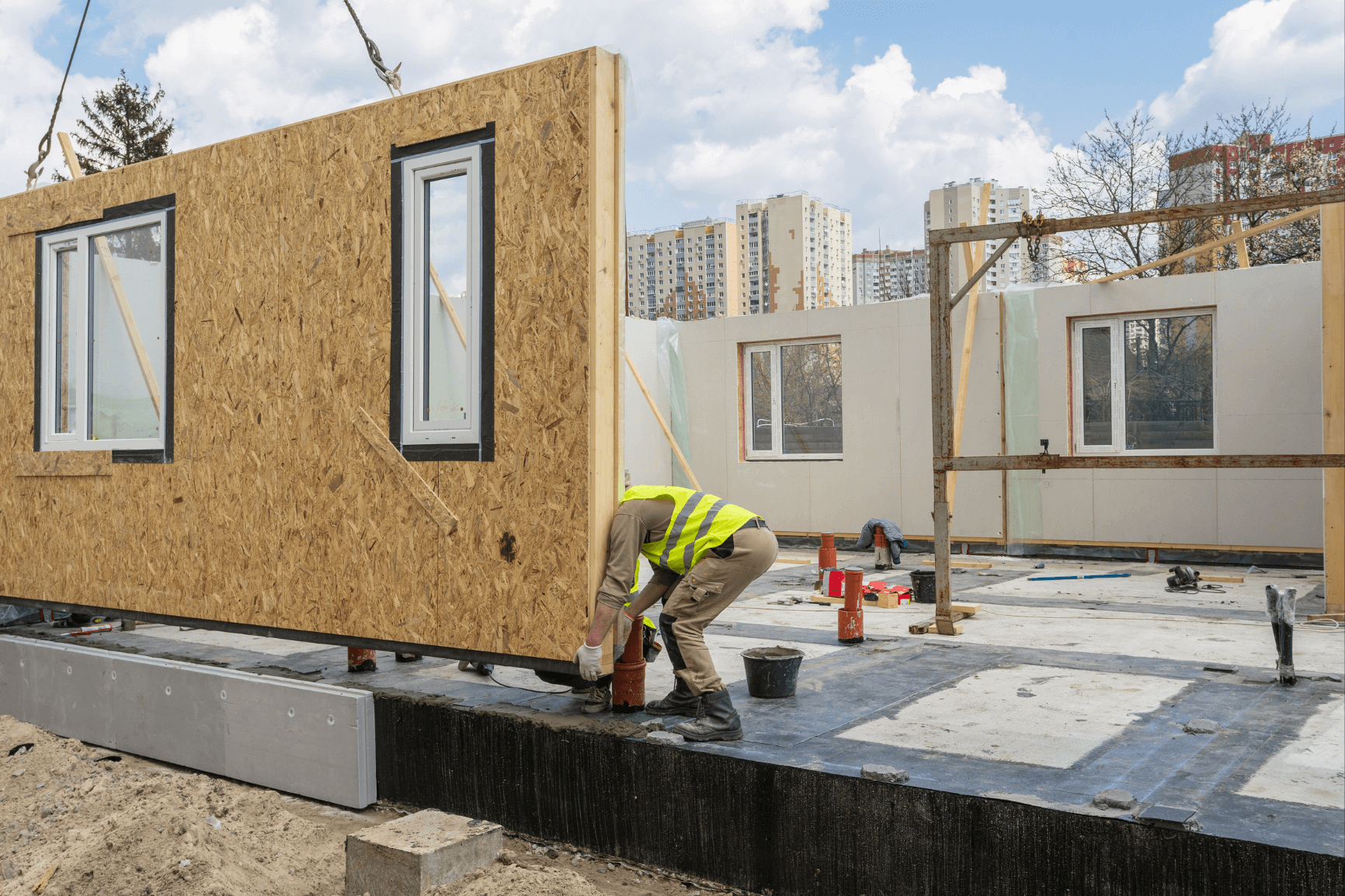

Site Management Challenges

Effective site management involves ensuring all workers are legally compliant. Subcontractors with tax debts may face restrictions that prevent them from working on-site, leading to labor shortages and project delays. It’s crucial for site managers to regularly verify subcontractor tax statuses and maintain up-to-date records to ensure smooth operations.

It’s really important for site managers to regularly verify subcontractor tax statuses and maintain up-to-date records to ensure smooth operations (Digital Construction Site Management Solution)

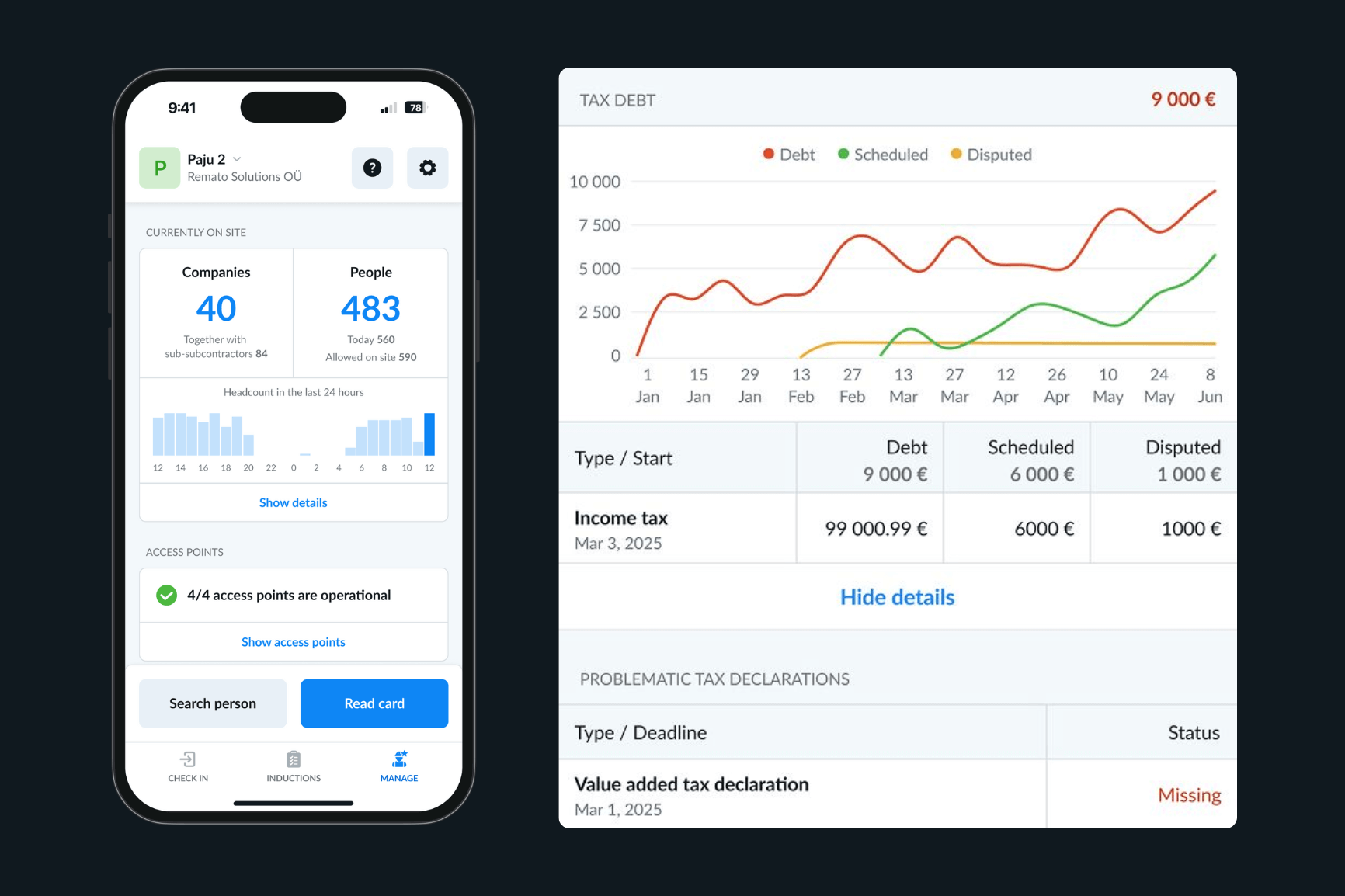

Tax Debt Example from Estonia

Estonia has become a focal point for tax compliance in the construction industry. According to Aktiva Finance Group, the number of businesses struggling to pay their taxes has increased significantly since the start of the coronavirus pandemic, and this trend shows no sign of reversing. Engaging subcontractors with unresolved tax debts in Estonia can lead to legal complications and project delays.

To address this issue, Remato has introduced a Site Management Tax Debt feature. This feature allows site managers to see which companies in the employment chain have current or historical tax debt. Companies with tax debt are marked in red, and clicking their row reveals detailed tax records. This helps site managers identify and monitor potentially problematic subcontractors more easily, thereby preventing delays caused by subcontractor tax debt.

Avoiding Risky Subcontractors

To mitigate the risk of delays due to subcontractor tax debt, consider the following steps:

- Conduct Thorough Checks: Always verify the tax status of subcontractors before hiring.

- Maintain Records: Keep detailed records of all subcontractor verifications and communications.

- Establish Clear Contracts: Ensure contracts include clauses that address tax compliance and the consequences of non-compliance.

- Regular Audits: Periodically audit subcontractor tax statuses to identify potential issues early.

Conclusion

Preventing project delays due to subcontractor tax debt requires proactive management, thorough verification processes, and clear contractual agreements. By understanding the tax regulations in your operating country and implementing best practices, you can safeguard your projects from unnecessary delays and legal complications.